Investors frequently search for clues in the stock market that will aid them in navigating through this fluctuating universe. In these many companies, two of them are rather noticeable: Lupin and ACC showing different segments. This piece examines the dynamic fluctuations of Lupin share price and ACC share prices to provide an analytical view of their movements.

- Lupin share price: A tale of pharmaceutical resilience

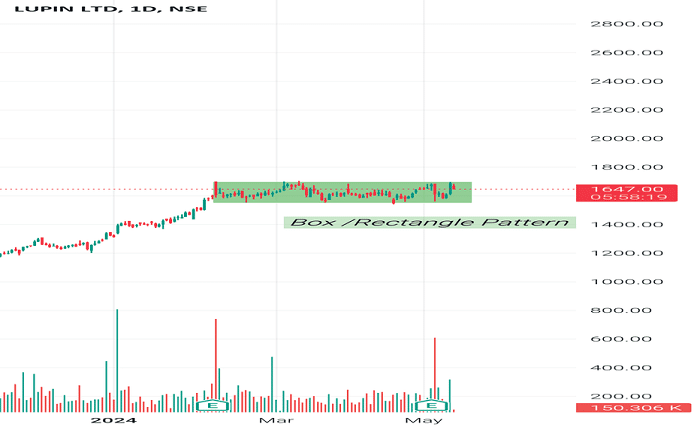

Lupin, a giant in pharmaceuticals, has been through various upheavals in the market environment. The company’s stock prices usually reflect intricacies encountered within the pharmaceutical sector such as drug approvals, patent expiry dates, as well as regulatory policy alterations. Investors keep a close watch on Lupins’ performance and analyze its quarterly reports and pipeline developments for prospects. Through regulatory scrutiny and market instability, lupins’ share price remains resilient; this is reflective of the company’s adaptability to changing times.

- ACC share price: Riding the waves of construction dynamics

In the construction materials field, ACC is like a rock amid turbulent market conditions. The way ACC share price rises and falls reflects the cycle nature of the building industry which is hinged on infrastructural projects, cement sales, and economic growth indicators. Investors look into it to see how well ACC is doing in terms of construction trends as well as demand-supply dynamics to predict market changes. Even though there are times when raw material prices go up or the government may interfere with its operations, the fate of ACC’s share price indicates the company’s capacity to withstand various changes witnessed by the construction sector.

- Market sentiment: Impacting Lupin and ACC share prices

The current feelings amongst investors affect how Lupin and ACC shares are priced. Upbeat information like drug endorsements, good earnings or infrastructure development undertakings usually raises these stocks thus attracting some optimism from traders. Conversely, negative happenings such as regulatory obstacles or a recession can prompt people to sell out their shares thereby putting downward pressure on stock prices of Lupin or ACC. Therefore, market sentiment becomes a gauge for investor perceptions and anticipations about these firms’ future.

- Industry trends: Navigating through sectoral dynamics

Both companies have been operating within different sectors with each being shaped by its peculiarities or patterns in business behaviour. Lupin’s path is determined by factors like patent expirations, generic competition, and healthcare reforms within the pharmaceutical industry. On the other hand, construction activities, infrastructure spending and real estate trends are the fortunes of ACC intertwined. Investors who want to understand the underlying forces that affect Lupin and ACC share prices need an understanding of these industry dynamics. Investment decisions can be made based on informed choices by keeping up with trends in industries.

- Financial performance: Decoding prices

Fundamentally, besides their share prices flip-flopping like acrobatic dancers, there are other things about the financial performance which make them swing. The healthiness of these firms is checked against key indicators like revenue growth, profit margins or debt ratios by investors. As a result of Lupin carrying out research and development along with launching new products, it affects its sales volume and profitability.

To sum up, it can be said that the dynamic swings of the Lupin and ACC share price are a reflection of an interplay between various factors ranging from industry trends and financial performance to market sentiment and future outlook. By understanding these dynamics closely, investors would be able to realize what moves Lupin and ACC shares prices thus allowing them to make informed investment decisions in this ever-changing stock market environment.